Introduction: Why Latency Is a Core Metric in Futures Trading

In modern electronic markets, low latency futures trading is no longer reserved for institutional firms or high-frequency trading desks. Even retail and proprietary traders now operate in an environment where execution speed directly influences results.

But a common question remains: What is actually considered “low latency” in futures trading?

Is 50 milliseconds fast enough? Is 10 milliseconds competitive? Or does low latency mean sub-millisecond execution?

This article breaks down what low latency truly means in futures trading, provides real-world benchmarks, explains how latency affects execution quality, and shows how traders can realistically achieve low-latency setups.

What Is Latency in Futures Trading?

In futures trading, latency refers to the total delay between:

- When an order is submitted

- When the exchange receives and processes the order

- When the execution confirmation is returned

Latency is typically measured in:

- Milliseconds (ms)

- Microseconds (µs)

Since futures markets such as CME operate on centralized electronic matching engines, all participants—regardless of size—compete within the same time-priority framework.

This makes latency a defining factor in execution quality.

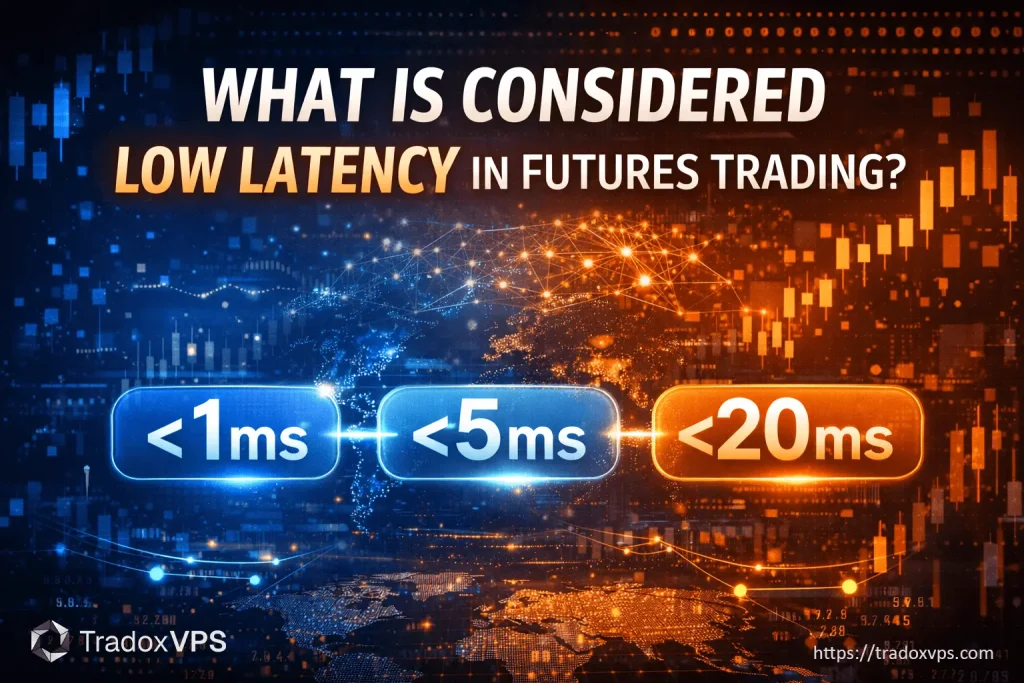

What Is Considered Low Latency in Futures Trading?

There is no single universal definition, but within professional trading environments, latency is generally categorized into ranges.

Latency Benchmarks in Futures Trading

| Latency Range | Classification | Typical Use Case |

|---|---|---|

| < 1 ms | Ultra-Low Latency | HFT, market making, co-location |

| 1 – 5 ms | Low Latency | Scalping, automated futures trading |

| 5 – 20 ms | Moderate Latency | Day trading, discretionary execution |

| > 20 ms | High Latency | Swing trading, non-time-sensitive strategies |

In most professional contexts, low latency futures trading means achieving under 5 milliseconds round-trip latency to the exchange.

Why Low Latency Matters in Futures Markets

Centralized Matching Engines

Unlike decentralized markets, futures exchanges such as CME operate a single centralized matching engine.

All orders must reach the same physical location—CME’s Aurora, Illinois data center—before execution.

This means:

- Distance equals delay

- Time priority determines queue position

Time-Priority Execution

Futures markets follow price-time priority. If two orders are submitted at the same price, the order that arrives first gets filled first.

Lower latency improves:

- Queue position

- Fill probability

- Execution consistency

Latency Sensitivity by Futures Trading Style

High-Frequency Trading (HFT)

HFT strategies require sub-millisecond latency. Anything above 1 ms may eliminate profitability entirely.

These traders typically use:

- Exchange co-location

- Custom hardware

- Direct market access

Scalping

Scalpers benefit significantly from latency below 5 ms.

Fast execution reduces:

- Slippage

- Missed fills

- Adverse selection

Day Trading

Day traders gain advantages from lower latency during:

- Market opens

- Economic news releases

- High-volume sessions

Latency under 10 ms is typically sufficient for discretionary day trading.

Swing and Position Trading

Latency has minimal impact for longer-term futures strategies, though it still affects stop-loss execution and gap risk.

Exchange Location and Its Role in Low Latency Futures Trading

Every futures exchange operates matching engines in specific data centers.

- CME Group: Aurora, Illinois

- ICE Futures: United States & Europe

- Eurex: Frankfurt, Germany

To achieve low latency futures trading, traders must minimize physical distance to these locations.

For CME futures, hosting trading platforms in Chicago provides:

- 1–3 ms round-trip latency

- Stable network routing

- Lower jitter

Official CME infrastructure details are available here: CME Group Technology Overview .

VPS Hosting and Low Latency Futures Trading

A trading VPS is one of the most effective tools for achieving low latency without the complexity of co-location.

A professional low-latency VPS offers:

- Proximity to exchange data centers

- Dedicated CPU resources

- Optimized network routes

- 24/7 uptime

Retail traders using a Chicago-based VPS can often achieve latency comparable to small proprietary trading firms.

Network Quality vs Raw Speed

Low latency is not just about speed—it’s about consistency.

Two connections with the same average latency may behave very differently depending on jitter and packet loss.

Professional trading infrastructure focuses on:

- Low jitter

- Predictable routing

- Minimal packet retransmission

Hardware and Software Factors

CPU Performance

High clock-speed CPUs reduce internal processing delays when handling market data and order generation.

Operating System Optimization

Latency-optimized systems disable unnecessary services and prioritize real-time networking.

Trading Platform Efficiency

Different platforms introduce different internal latencies. Well-optimized setups reduce chart load, indicators, and background tasks.

Measuring Latency in Futures Trading

Traders can measure latency using:

- Platform execution timestamps

- Broker latency metrics

- Ping and traceroute tests

Consistent monitoring helps identify infrastructure bottlenecks.

Common Misconceptions About Low Latency Futures Trading

“Only HFT Needs Low Latency”

While HFT benefits most, active retail traders also gain better fills and reduced slippage from lower latency.

“Internet Speed Equals Low Latency”

Bandwidth and latency are different. High-speed home internet does not guarantee low execution latency.

“Broker Location Is Everything”

Exchange proximity matters more than broker headquarters.

FAQs: Low Latency Futures Trading

What latency is considered low for futures trading?

Under 5 milliseconds round-trip latency is generally considered low.

Is sub-1ms latency necessary?

Only for HFT and market-making strategies.

Can retail traders achieve low latency?

Yes. A properly configured VPS near the exchange can deliver sub-5ms latency.

Does low latency guarantee profitability?

No, but it preserves execution quality and strategy edge.

Is VPS better than home trading for latency?

Yes. VPS hosting near the exchange offers lower, more consistent latency.

Final Thoughts: Defining Low Latency in Futures Trading

Low latency futures trading is best defined not by hype, but by measurable execution performance.

For most active futures traders:

- < 5 ms = low latency

- 1–3 ms = highly competitive

- < 1 ms = institutional-level

In modern futures markets, speed is not optional—it is part of the strategy. Understanding what qualifies as low latency allows traders to make smarter infrastructure decisions and trade on equal footing in an increasingly competitive environment.