For algorithmic traders, scalpers, and anyone running automated strategies, infrastructure decisions can directly impact execution quality. Among these decisions, server location trading latency is often the most critical factor.

This article provides a structured, data-driven comparison of TradoxVPS and ChartVPS. The goal is not promotion, but to help traders understand how differences in hardware, network capacity, and latency may influence real-world trading performance.

Note: This comparison is based on publicly available specifications and benchmark data. Actual results may vary depending on broker location, strategy type, and market conditions.

Why Server Location & Trading Latency Matter

Trading latency refers to the time it takes for an order to travel from a trading platform to a broker’s server and back. When a VPS is geographically closer to a broker’s data center, this communication delay is reduced.

Lower server location trading latency is especially relevant for:

- Scalping strategies

- High-frequency or semi-HFT trading

- News and volatility-based execution

- Expert Advisors (EAs) sensitive to execution timing

As outlined by Investopedia, even small delays can impact fill quality, slippage, and long-term strategy performance.

Overview of the Compared VPS Services

Both TradoxVPS and ChartVPS provide Windows-based Trading VPS solutions intended for continuous operation. They target traders who require stable uptime, predictable execution, and consistent performance.

The comparison below focuses on similarly positioned plans designed for active trading workloads.

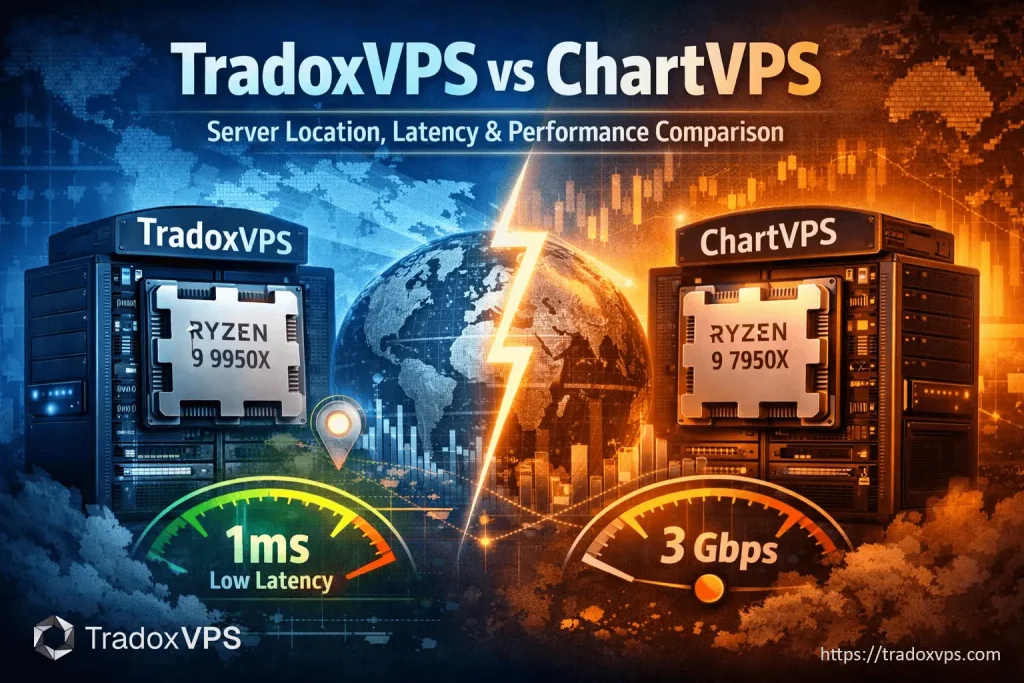

Plan Hardware Comparison

| Specification | TradoxVPS (Active) | ChartVPS (Mark-2) |

|---|---|---|

| Processor | AMD Ryzen 9 9950X (Zen 5) | AMD Ryzen 9 9950X (Zen 5) |

| Allocated Cores | 4 | 4 |

| Base / Boost Clock | 4.3 GHz / 5.7 GHz | 4.3 GHz / 5.7 GHz |

| Memory | DDR5 16GB | DDR5 16GB |

| Storage | NVMe 300GB | NVMe 256GB |

| Operating System | Windows Server 2022 | Windows Server 2022 |

| Monthly Price | $69 | $120 |

Latency, Network Speed & Stability

Both providers advertise ultra-low latency environments, which is a baseline expectation for modern trading VPS solutions. However, network capacity also plays a role during peak market activity.

| Metric | TradoxVPS | ChartVPS |

|---|---|---|

| Average Latency | ~1 ms | ~1 ms |

| Network Throughput | 3+ Gbps | 3 Gbps |

| Advertised Uptime | 99.999% | 99.999% |

As explained by Cloudflare, consistent performance depends on both low latency and sufficient bandwidth, particularly during high-volume data exchange.

Trading VPS vs Personal Computer

Many traders initially operate from personal laptops or desktops. While sufficient for manual trading, this setup introduces limitations for automated or continuous strategies.

| Scenario | Typical PC Setup | Trading VPS Environment |

|---|---|---|

| Latency | 100+ ms | ~1 ms |

| Uptime | Dependent on power & internet | Data-center grade availability |

| Network Speed | 100 Mbps – 1 Gbps | Multi-Gbps backbone |

| 24/7 Operation | Limited | Designed for continuous use |

Cost Considerations

Pricing is often a secondary factor for traders focused on execution quality, but it remains part of the overall value assessment.

- TradoxVPS: $69 per month

- ChartVPS: $120 per month

When evaluating cost, traders should consider how hardware specifications, network capacity, and latency align with their strategy requirements rather than price alone.

Which Type of Trader Benefits Most?

Rather than declaring a universal winner, it is more useful to consider suitability:

- Latency-sensitive scalpers may prioritize proximity to broker servers

- EA users may benefit from stronger single-core CPU performance

- Multi-platform traders may require additional memory and storage

Understanding these requirements helps traders select a VPS aligned with their execution needs.

Conclusion

Choosing a Trading VPS is a technical decision that directly impacts execution reliability. This comparison highlights how differences in CPU generation, memory allocation, network throughput, and pricing can influence overall value.

For traders evaluating options through the lens of server location trading latency, infrastructure transparency and measurable performance metrics remain the most important factors.

Ultimately, the best VPS is the one that aligns most closely with a trader’s strategy, broker location, and performance expectations.